The Best Corporate Card for Nonprofits

Revolutionize your organization with a corporate card that's specifically designed for nonprofits to save you time and money with ease.

No credit checks or personal guarantee

Corporate cards built for nonprofit accountability

Cash-backed Visa® cards that follow your fund and grant rules automatically, so staff can spend confidently while you stay in control.

Cards tied to funds, not chaos

Built-in spend controls for grants, programs, and trips

Real-time visibility for finance, boards, and auditors

Why finance teams love Devote cards

Everything your board wants to see from card usage, without the spreadsheet circus.

Cards that follow your fund rules

Tie each card to a fund, program, or grant so you never have to re-tag card spend by hand.

Controls you actually use

Set per-card limits, merchant categories, and time windows that match your policies. Then let Devote enforce them.

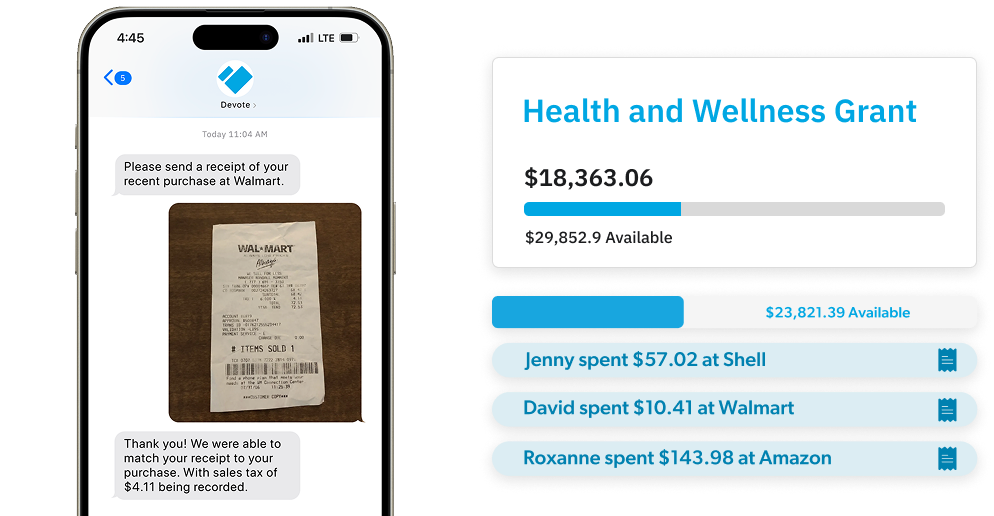

Receipts and coding handled in real time

Staff snap a photo or forward an email; Devote matches, codes, and syncs to your ledger.

Audit-ready, board-ready reporting

Every transaction has a cardholder, fund, and receipt attached. So auditor pull requests stop derailing your month.

Built for nonprofit controls and compliance

Devote cards are designed for grant rules, fund restrictions, and board oversight. Not just generic business spend.

-

Fund & grant-aware limits

Cap spend by fund, program, or trip so you never accidentally overspend a restricted grant.

-

Category & vendor controls

Allow or block categories like travel, hotels, or alcohol—and specific vendors—to match your policies.

-

Automatic card locking

Lock cards after a project ends, after a trip, or if receipts aren’t submitted on time.

-

Paperless audit trail

Every card transaction is tagged, documented, and exportable by fund, grant, or program for audits and 990 prep.

Say goodbye to reimbursements and shared cards

Make it easy for staff and volunteers to spend on behalf of your mission without chasing receipts or passing around one fragile card.

-

No more chasing receipts

Staff and volunteers use their own Devote cards instead of a shared church or agency card, and capture receipts on the spot.

-

Simple for staff and volunteers

They tap their card, snap a photo, and Devote handles the coding rules behind the scenes.

-

Safer than passing around one card

Each person, trip, or program can have its own card, so you always know who spent what and where.

How the Devote card works

Devote cards are cash-secured Visa® charge cards connected to your Devote account—not a new credit line—so every swipe follows your nonprofit’s fund structure.

Fund your Devote account

Move money into Devote from your operating bank account. Segment it into buckets for grants, programs, and reserves.

Issue cards from those buckets

Create physical or virtual cards for staff, programs, and trips. Each card is tied to a specific fund, grant, or department.

Spending stays in bounds

When a card is used, Devote enforces the limits, categories, and fund rules you set. Then syncs everything back to your accounting system.

Devote cards vs. traditional bank cards

Bank cards were built for generic business spend. Devote cards are built for nonprofit finance and accountability.

Good enough for business. Not built for nonprofits.

- •One or two shared cards for the whole org.

- •Manual tagging by fund or grant after the fact.

- •Limited controls and weak reporting.

- •Reimbursements and personal cards filling the gaps.

Designed for fund accounting and oversight.

- •Unlimited cards for staff, programs, and trips.

- •Spend tied to funds, grants, and programs from the first swipe.

- •Fine-grained controls and real-time alerts.

- •Receipts, coding, and reporting all in one place.

Devote card FAQs

Answering the questions boards, CFOs, and controllers ask us most often—up front.