Best High-Yield Savings Account for PTAs, PTOs & Booster Clubs (FDIC-Insured Up to $50M)

Stop letting bake-sale dollars earn 0.1%. PTAs, PTOs, and school booster clubs across the U.S. often keep fundraiser funds in basic bank accounts earning under 0.4% APY. It’s time to make those dollars work harder for students. A PTA high-yield savings account can boost your interest earnings dramatically without sacrificing safety or access. In this post, we’ll explore how the best high-yield savings account for PTAs, PTOs, and booster clubs – the Devote Savings Account – helps you earn materially higher interest (around 3% APY) while maintaining full liquidity and control. Every extra dollar earned in interest is a dollar that can fund field trips, instruments, uniforms without another fundraiser.

The Fundraising Gap: Dollars Sitting Idle in 0.1–0.4% Accounts

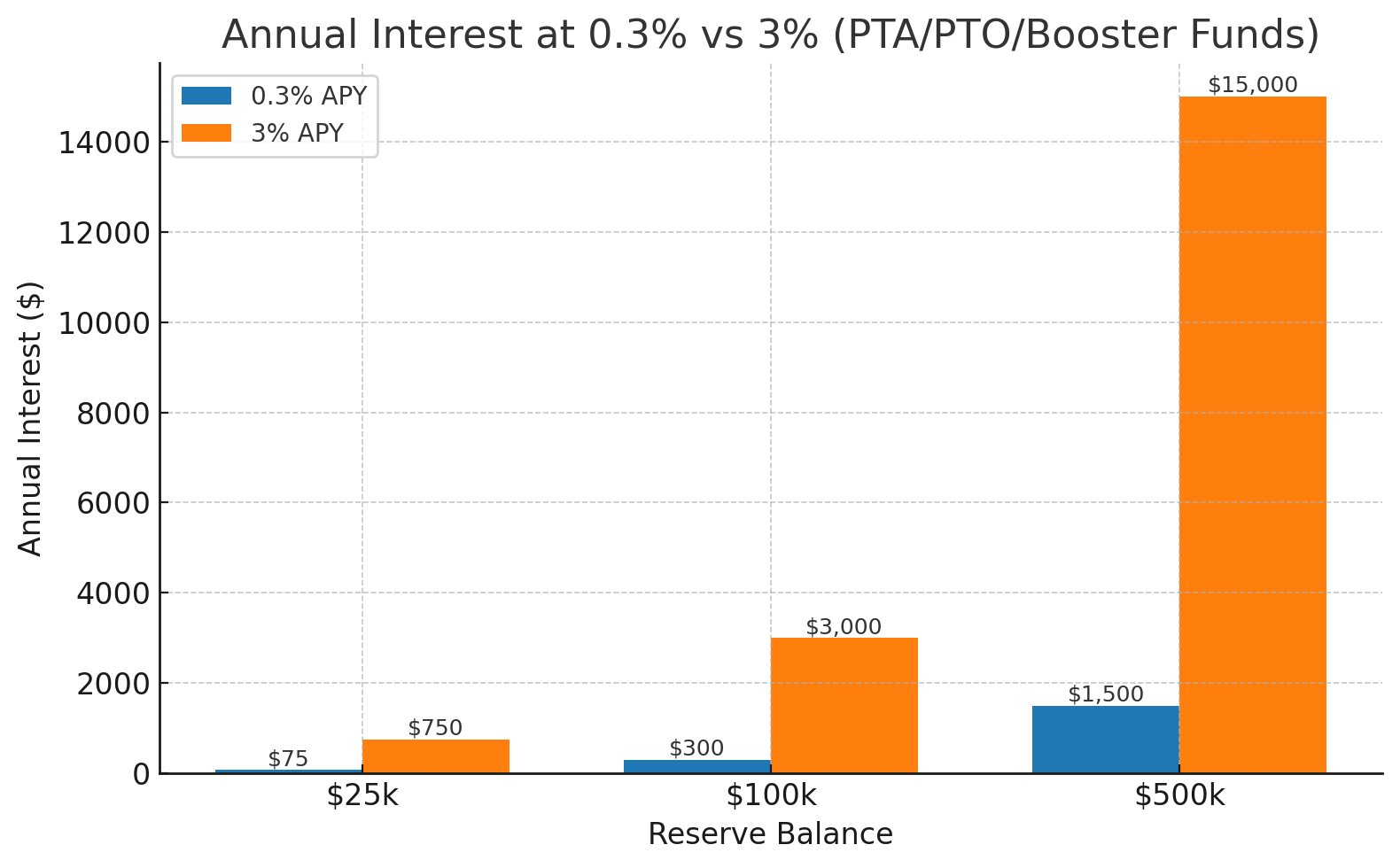

Most parent-teacher groups keep their money in standard checking or savings accounts that pay virtually nothing, often 0.1%–0.4% APY. At those sub-1% rates, your hard-raised funds are essentially sitting idle. By contrast, a high-yield savings account (HYSA) can pay in the range of 3% APY, which is about 8× higher than the national average for savings. That gap has real consequences for your budget:

Example 1: A typical PTA with $100,000 in reserve earns only about $300/year at 0.3% APY, but $3,000/year at 3% APY. That extra $2,700 could fund roughly nine new teacher mini-grants or an entire grade’s science lab supplies.

Example 2: A larger district-wide booster club with $1 million idle at 0.3% earns just $3,000 annually, versus $30,000 at 3%. That’s an additional $27,000/year in “free” money, enough to purchase a full set of marching band uniforms or cover travel and lodging for a big competition.

PTA high-yield savings interest comparison. Even a modest PTA reserve like $25,000 would earn only about $75 a year at 0.3% APY, versus $750 at 3% APY (as illustrated above). Now picture larger booster budgets in the six figures – the lost interest from staying in a low-yield bank account quickly scales into the thousands of dollars.

The message is clear: every fundraiser dollar should be earning for you. In fact, nonprofits collectively forfeit billions in lost interest each year by sticking with near-zero accounts. Moving your PTO’s reserves into a high-yield, FDIC-insured account is one of the easiest ways to generate extra funds for students without any additional fundraising. It’s pure stewardship, making donor dollars go further in support of your mission.

School-Year Cash Cycles = You Need Yield and Liquidity

You might be thinking: “We can’t lock up our money, we need it accessible for expenses.” Absolutely. School organizations have seasonal cash flow and must balance earning interest with staying liquid. The good news is that with the right account, you can have both yield and liquidity.

Consider a typical school-year cycle: many groups collect a flood of cash in the fall (membership dues, fall fundraisers) and spring (galas, auctions). Between events, balances swell for months at a time before those funds are spent on programs. For example, you might raise $50,000 in the fall and not use it fully until well into spring – that’s money that could sit in a high-yield account earning interest during the interim. Conversely, during busy periods you have frequent outflows: pre-paying for field trip buses, sports tournaments, band travel, camp deposits, etc. Sometimes unexpected needs arise (a competition gets rescheduled or a vendor needs a rush payment). Liquidity is critical.

A specialized solution like Devote’s HYSA is built for this stop-and-go cash rhythm. You earn ~3% APY on balances during the lull periods, but funds remain fully liquid with same-day or next-day access. There are no penalties or waiting periods to transfer money back when you need it. In fact, Devote enables same-day ACH transfers so you can move funds to your checking account almost immediately for an urgent expense. (Need to pay the bus company tomorrow for the choir trip? No problem, initiate a transfer today and the money’s in your bank by morning, with no interest penalty.) Traditional savings options often make you wait multiple days for transfers, but Devote understands school groups can’t afford delays when students are counting on that bus or hotel. You get the high yield and the on-demand liquidity.

Equally important, Devote’s savings account has no minimum balance requirements after opening and no withdrawal fees. You’re free to top up or draw down as your cash flow demands, without worrying about bank fees eating into your funds. The result is a school-friendly financial tool: you maximize interest earnings during the “idle” months, yet your money is instantly deployable for the next booster purchase or last-minute need. It’s yield without sacrificing control, the perfect fit for PTA/PTO and booster club cycles.

Buckets Honor Donor Intent & Simplify Audits

Every PTA/PTO treasurer knows the headache of tracking restricted funds and keeping donor-designated money separated. You might have booster bylaws or grant requirements that certain funds (like the playground fund or scholarship fund) not mix with general operating money. Too often, groups attempt this with messy spreadsheets or multiple bank accounts, which is error-prone and hard to hand off to the next volunteer. Devote solves this elegantly with “buckets”: unlimited sub-accounts within your main savings.

Think of buckets as digital envelopes for each purpose or program. You can create a bucket for Teacher Grants, Field Trips, Athletics Travel, Band/Choir, Robotics, Capital Improvements, Senior Gifts, or any category that matters to your group. Each bucket has its own nickname and balance. For example, if your bylaws say fundraising for the Playground Fund must be kept separate, simply make a “Playground” bucket and deposit those donations there. You’ll always see exactly how much is set aside for that purpose (down to the penny), with no commingling risk. Your general operating funds stay in their own bucket, untouched.

Why is this a game-changer? Traditionally, treasurers used Excel or multiple bank accounts to simulate fund accounting. Anyone who’s tried that knows the pain, endless tabs, formulas, manual updates, and chances for error. One miscategorized expense or forgotten update can throw off your records. And when a new treasurer takes over, deciphering those spreadsheets (or juggling five separate bank accounts) is daunting. With Devote, it’s all in one secure platform: no complicated reclasses, no accidental overspending restricted money, and a seamless transition year to year.

Transparency and trust also skyrocket. If you raise $10,000 for the “8th Grade Trip,” parents can trust it’s in the 8th Grade Trip bucket, not accidentally spent elsewhere. In fact, Devote provides board-ready reports that even show interest earned per bucket, so your restricted funds actually grow for their intended purpose. (No traditional bank is going to break out how much interest your band fund earned versus your scholarship fund, but Devote will.) At audit time, you can produce statements that clearly detail each sub-account’s activity and balance, making compliance a breeze.

Perhaps best of all, buckets save volunteer hours. Devote automatically tracks how much of your one big account belongs to each program, sparing you the tedious manual bookkeeping. One nonprofit user noted they had relied on manual spreadsheets and “countless hours” of data entry yet still struggled with clarity, until they switched to Devote buckets. With the buckets feature, that organization saved 10–15 hours per month of bookkeeping work and finally had real-time visibility into all funds. Even for a smaller PTA, freeing up 4-5 hours a month from tedious accounting means more time you can spend organizing events or with your family instead of being stuck in “Excel hell”. Devote gives you the clarity of separate accounts with the convenience of one platform, plus interest earnings on every dollar (yes, even money sitting in the “Field Trip” bucket accrues interest until it’s used).

Case Study: Riverview PTA Puts $20k/Year Back Into Classrooms

To see the impact in action, let’s look at a parent group that made the switch. The Riverview Elementary PTA (1,200 students) was handling around $350,000 in annual fundraising revenue, and maintaining roughly $200,000 in operating reserves year to year. They kept these funds at a local bank in a basic business savings account earning a paltry 0.25% APY. That yielded only about $500 a year in interest – barely enough to cover two teacher stipends. The PTA board assumed this was just the “price of safety,” as many large banks offered virtually nothing to small nonprofits.

Making the Switch: In 2024, Riverview’s treasurer learned about Devote through another PTA and decided to “run the numbers.” At Devote’s ~3.0% APY rate, their $200k reserve could earn about $6,000 in interest per year, versus $500 at their bank – an extra +$5,500 annually. That equates to roughly 20 additional document cameras for classrooms, or a new set of tablets for the computer lab every year, for free. With board approval, they opened a Devote High-Yield Savings Account (it took just a day to set up online) and moved their reserve funds over. The immediate result was over $5,000 in interest earned in the first year, money which the PTA directed right back into classroom grants and student programs.

Buckets & Transparency: Riverview’s PTA also took advantage of Devote’s unlimited buckets. They created six buckets aligned to their budget categories: General Operations, Teacher Mini-Grants, Field Trips, Arts & Music, Facilities/Playground, and Family Events. This helped them honor donor intent – for instance, proceeds from the Jog-a-thon (earmarked for the playground) went straight into the Facilities bucket. The PTA’s finance committee loved seeing exactly how much was available for each category, with no more manual tracking in Google Sheets. Quarterly statements from Devote showed interest earned for each bucket, which impressed the school principal and auditors during the annual financial review. One finance chair remarked that “Devote basically did our audit prep for us – every penny is accounted for by purpose.”

Time Savings & Easy Transitions: On the operations side, Riverview’s treasurer noted they saved about 4 hours per month in bookkeeping and reconciliation tasks after switching to Devote. Because all their funds lived in one platform, they no longer had to juggle reports from multiple bank accounts or constantly move money around. Devote’s QuickBooks integration meant deposit and withdrawal data flowed automatically into their accounting software, reducing manual data entry (and errors). When it came time to hand off to a new treasurer at the end of the school year, the transition was virtually foolproof: instead of driving to a bank to change signatories, they simply added the incoming treasurer as a user with the appropriate access and removed the outgoing one. In minutes, the new treasurer had full visibility of every bucket and transaction, a far cry from the old box of binders and spreadsheets. “It was the easiest turnover we’ve ever had,” said the PTA president. “Devote made our finances treasurer-proof, even mid-year.”

Why Devote Beats a Traditional Bank for PTAs/PTOs/Boosters

At this point, you might wonder: Why not just find a better rate at a regular bank or credit union? The reality is, traditional banks aren’t built for the unique needs of volunteer-run school groups. Devote is. It’s a financial platform designed exclusively for nonprofits (parent groups, booster clubs, churches, charities) – which means it addresses pain points that generic banks often ignore. Here’s how Devote outshines a typical bank for PTA/PTO and booster club finances:

Much Higher Interest (Market-Leading APY): Devote offers around 3.00% APY on all deposits, one of the highest yields available to nonprofits. Most banks offer near-zero rates to small organizations, many PTAs are stuck at 0.1%–0.2% today. By consistently leveraging a network of banks to get top rates, Devote ensures your reserves actively grow. It’s like earning an annual grant without any extra work. In short, 3% vs 0.2% is the difference between your money on rocket fuel versus parked in neutral.

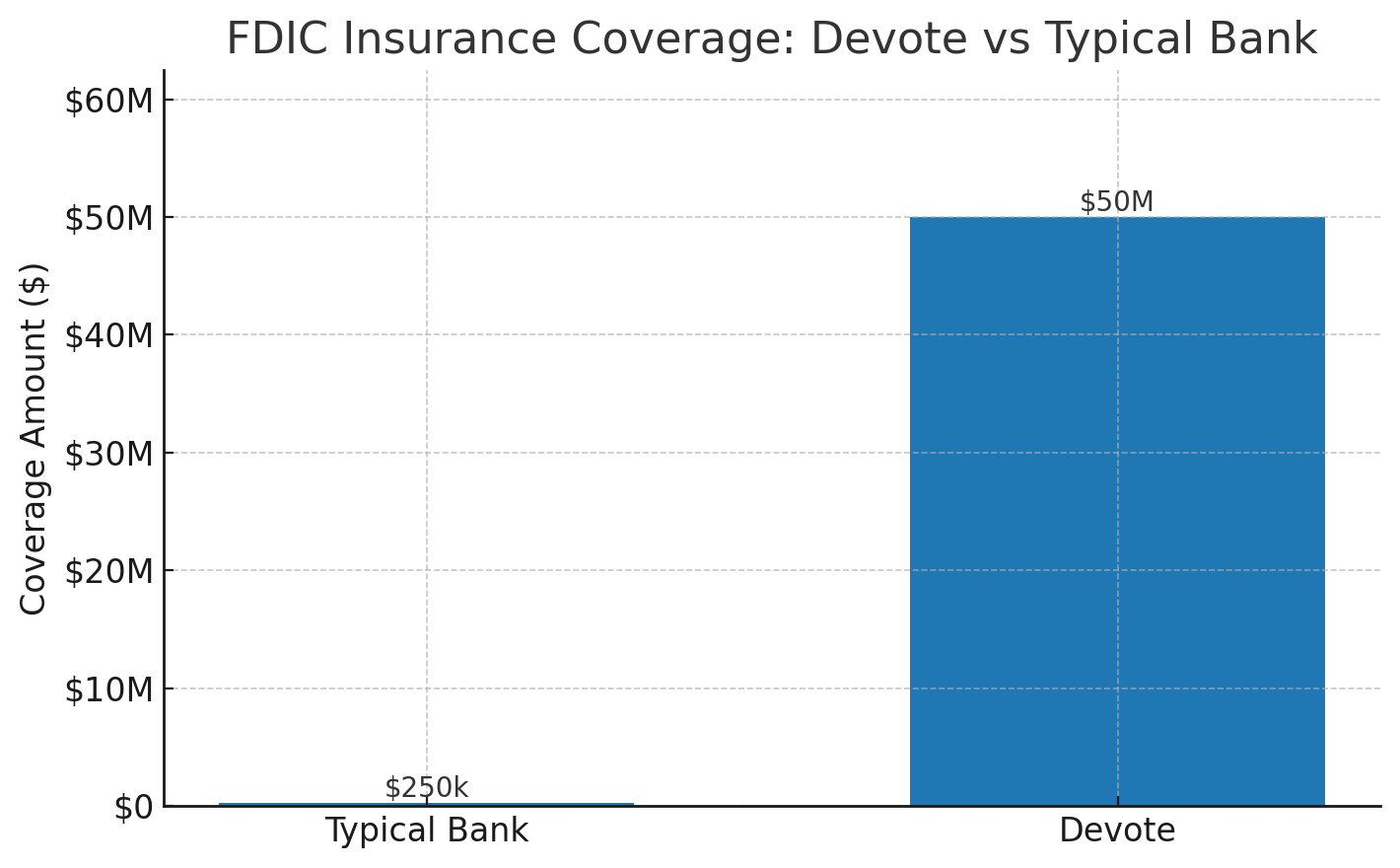

Unparalleled FDIC Insurance (Up to $50 Million per EIN): Typical banks only insure up to $250,000 per account, fine for a small PTA, but larger booster programs or combined district funds can exceed that, leaving money at risk. Devote solves this via an FDIC-insured sweep network that protects deposits up to $50 million per tax ID. Your funds are spread across partner institutions behind the scenes, so even the largest booster club or education foundation can keep every penny federally insured. This 200× higher coverage provides peace of mind to boards and school districts alike. (Try asking a big bank to insure $5 million for your band booster, they won’t, but Devote will!)

Unlimited “Buckets” at No Cost: Unlike a regular bank, Devote lets you segregate money into as many sub-accounts as you need for free. No need to actually open multiple accounts or meet multiple minimum balances. Whether you have 3 funds or 30 funds, they’re all neatly organized under one login. This built-in fund accounting means zero extra fees or hassle to track restricted donations, a huge win for transparency and audit readiness. (Many banks would make you open separate savings accounts, and maybe charge fees on each, if you wanted to mimic this.) With Devote, it’s just a few clicks to add a labeled bucket whenever you launch a new fundraiser or program.

QuickBooks Integration & Receipt Capture: Devote isn’t just a bank account; it’s also a spend-management platform. It syncs directly with QuickBooks Online and other accounting software, so your transactions can auto-import into your books, saving you from manual data entry. It even offers automatic receipt capture, when your officers or committee chairs spend money using a linked Devote card, they can snap a photo of the receipt and it attaches to the transaction. This means no more chasing receipts or guessing what that $258 charge at “ABC Enterprises” was for, the documentation is right there. NerdWallet’s finance experts were so impressed by these workflow benefits that they rated Devote 4.4 out of 5 stars and named it the “Best Spend-Management Platform for Nonprofits.” In practice, Devote can practically eliminate expense reports for your PTA and streamline the monthly close.

Same-Day Transfers (Fast Liquidity): Unlike some online accounts, Devote knows you might need money now. It enables same-day or next-day ACH transfers out to your regular checking account. So if the school asks the PTO to cut a check tomorrow for new Chromebooks, you can quickly pull the needed amount from your high-yield reserve. There are no withdrawal penalties or limits on frequency. This responsiveness is crucial for handling “uh-oh, we need funds ASAP” moments, something many brick-and-mortar banks can’t promise for small nonprofits.

Zero Fees & No Minimums: As volunteer-led groups, we hate seeing fundraising dollars wasted on bank fees. Devote was built with that in mind: no monthly fees, no maintenance charges, no transfer fees, and no hidden fees at all. There’s just a token $1,000 minimum to open the account (easily met by most PTAs), and after that, no required minimum balance. In contrast, many business bank accounts charge $10–$25 a month or require hefty balances to waive fees, money that should be going to your programs, not the bank’s profits. With Devote, every dollar stays committed to your mission. Transparency is core to Devote’s ethos, so you won’t get nickel-and-dimed.

Built for Easy Oversight & Transitions: Devote’s platform was built by nonprofit experts who understand how important oversight and continuity are for groups with rotating officers The account allows role-based access, meaning you can give your president, treasurer, finance committee, or school bookkeeper appropriate read-only or full access as needed. No more sharing one login or feeling like only the treasurer can see “the books.” This makes year-end audits and board reviews far more comfortable – everyone can have transparency. Moreover, when officers change, adding the new treasurer (and removing the old) is simple, avoiding the notorious hassle of changing bank signatories (which often requires all new officers to visit a branch in person). Devote has anticipated those needs and made the interface super user-friendly. The result is an account that is volunteer-proof: it stays consistent and secure through leadership changes, and you’ll never have to “re-explain” to a clueless bank why you need multiple subaccounts or multiple users. Devote speaks PTA/PTSA language out of the box.

Comparison of Devote’s nonprofit HYSA vs. typical bank. Devote offers ~3.00% APY (around 7× the national average of 0.46%) and FDIC insurance up to $50 M (200× the standard $250k cap). This superior yield and safety mean booster clubs can significantly grow funds without sacrificing security.

In short, Devote delivers the best of both worlds for school organizations: top-tier financial returns and nonprofit-tailored features. It’s not just “another bank account”, it’s a holistic solution to make your treasurer duties easier and your fundraiser dollars mightier.

Common Concerns, Addressed: We know any change can raise questions. Here are a few common objections PTA/PTO leaders have and how Devote addresses them:

“Will our district approve an online account like this?” – Devote is fully FDIC-insured and provides transparent, auditable records. Many school districts already permit such accounts, especially given the enhanced oversight. You can even give district officials or principals read-only access if needed to satisfy any oversight requirements. When every penny is federally insured and trackable, district finance offices are typically on board.

“What if we need funds tomorrow?” – No worries. With same-day/next-day ACH, you can transfer money out of Devote and into your school checking account quickly. There are no penalties or waiting periods. Devote knows emergencies happen. If the marching band’s bus company demands payment ASAP, you can get the cash overnight. In practice, it’s as liquid as your current checking account, just earning a lot more in the meantime.

“Can we track restricted funds easily?” – Absolutely. Devote’s unlimited buckets allow precise tracking of each fundraiser or grant. You’ll know exactly how much is in the “Drama Club Trip” bucket or the “STEM Grant” bucket at all times, and even how much interest each has accrued. This granularity actually exceeds the tracking capability most PTAs have today, making your finance reports crystal clear. No more commingling or guesswork.

Next Steps: Put Your Fundraiser Dollars to Work

You’ve worked hard to raise these funds, now let’s make them work hard for you. With Devote’s high-yield savings account, you can earn more for your students without any extra fundraising. It’s the safest, simplest way to stretch every dollar further in support of your school.

Ready to see how much more your PTA/PTO could be earning? [Calculate Your PTA’s Lost Interest] (use our free calculator tool) by plugging in your average bank balance and current rate. You might be shocked at the annual interest you’re leaving on the table. Often, it’s enough to fund an extra field trip or a new set of laptops each year with zero additional bake sales. This eye-opening number can help convince your board that it’s time for a change.

Want to get organized first? [Download the “Bucket Blueprint” (free worksheet)] to map out your group’s funds and goals. This worksheet helps identify which buckets you’d set up (e.g. General Operations, Emergency Reserve, 5th Grade Science Camp, Library Fund, etc.) and how much you’d allocate to each. It’s a great exercise to involve your finance committee in and when you’re ready to move to Devote, you’ll have a clear blueprint of how to structure your sub-accounts. In fact, you can bring this filled-out sheet to your Devote onboarding, and their team will help you set up each bucket in minutes.

Make the Switch: When you’re ready, opening a Devote High-Yield Savings Account is simple and fast, you can apply online in minutes and have your account ready to fund usually within one business day. There’s no lengthy paperwork or branch visit required. Once opened, you’ll transfer in your funds, set up any desired buckets, and start earning interest right away. Devote’s team is there to assist with any questions (they’re used to working with volunteer treasurers, not finance pros, so they make the process very user-friendly).

Bottom line: You owe it to your students to make every dollar count. By upgrading your PTA or booster club’s banking to a high-yield, high-insurance solution like Devote, you’re practicing smart stewardship and unlocking funds that were hiding in plain sight. It’s free money for your mission. No new fundraiser, no extra volunteer hours. Just a better home for your hard-earned reserves.

🔒 FDIC Insured up to $50 Million 🚀 3.00% APY – 7× Higher Yield 💸 Same-Day Access to Funds 🗂️ Unlimited Fund “Buckets” 📊 QuickBooks Integration 💳 Free PTA Corporate Card Option

Ready to put those idle dollars to work for your school? Open a Devote High-Yield Savings Account and watch your fundraiser dollars grow for the kids.

FAQ

Q: What happens if interest rates change?

A: Devote’s APY is variable, so it can adjust with the market. However, Devote consistently leverages a network of banks to keep rates among the best for nonprofits (currently around 3%). If general rates rise or fall, Devote’s rate may move too, but it will always notify you of the current APY, and it aims to stay highly competitive (far above big-bank averages).Q: How can Devote insure up to $50 million? Is that legit?

A: Yes. Devote uses an FDIC-insured sweep network. This means your deposits are distributed across multiple partner banks, each providing $250k of insurance under FDIC rules, all under your PTA’s tax ID. You still see one combined account balance, but behind the scenes your funds are spread out to stay fully insured. It’s a common practice (used by many large cash management programs), Devote just brings it to nonprofits. You get a single statement and interface, and full FDIC protection on every dollar.Q: How long does it take to open and set up?

A: You can typically open an account online in one day. The application will ask for your organization’s basic info (EIN, address, etc.) and authorized persons. Once approved, you fund the account via ACH transfer. Setting up buckets is instant. You can create and name sub-accounts in seconds. Overall, many PTA treasurers have been able to go from application to having funds earning interest within 2–3 business days.Q: How do we handle adding new officers or changing account signers?

A: Devote allows multiple users with custom permissions, so adding a new treasurer or finance chair is as easy as sending an invite through the dashboard. There’s no need to visit a branch or redo signature cards. You can grant view-only access to auditors or district officials if needed, and easily remove access for former officers. This role-based access and easy user management make year-to-year transitions smooth and ensure financial continuity despite volunteer turnover.Q: Our PTO has checking at a local bank. Do we need to close it?

A: Not at all. Devote’s savings account can work alongside your existing checking account. In fact, that’s recommended: use Devote to hold your reserves and longer-term funds (earning high interest), and transfer funds to your regular checking as needed for writing checks/debit use. Many groups keep a few thousand in checking for immediate expenses and park the rest in Devote to grow. Think of Devote as your high-yield reserve account, complementing (not necessarily replacing) your day-to-day bank. Over time, you might even find Devote’s integrated tools replace the need for a traditional bank account, but you can transition at whatever pace is comfortable.

Now’s the time to stop leaving money on the table. By switching to a purpose-built PTA high-yield savings account like Devote, you transform idle dollars into active support for your students and teachers. It’s safe, smart, and simple. A win-win for your school community. Here’s to making every fundraiser dollar work harder for our kids!

Extra you earn with Devote annually$0

*Rates as of July 23 2025. Devote APY may change at any time.

**Demo assumes 365 days; National‑average rate from

Bankrate survey.