Why Devote Is the Smartest High‑Yield Savings Account for U.S. Sports Clubs & Associations

Sports clubs and athletic associations across the U.S. manage millions in collective funds, yet much of this money sits “benched” in checking or basic savings accounts earning almost nothing. In fact, youth and amateur sports generate an estimated $45 billion in annual economic activity (travel, tournaments, fees), but most clubs earn under 0.4% interest on their reserve funds. That means your club’s money isn’t working as hard as your athletes are. By contrast, a high-yield account like Devote’s, built for nonprofits and sports organizations, can pay around 3% APY, drastically increasing your revenue without raising dues or selling more candy bars. This article explores the funding gap and why moving your team’s idle cash into Devote’s high-yield savings account for sports clubs is a game-changer. You’ll see how one club earned an extra $20K (funding 3 new turf fields), how “buckets” simplify sports finances, and why Devote beats traditional banks for athletic associations. (Spoiler: It’s about fulfilling our mission to the kids by making every dollar count.)

The Competitive Funding Gap: Millions Benched in Low‑Yield Accounts

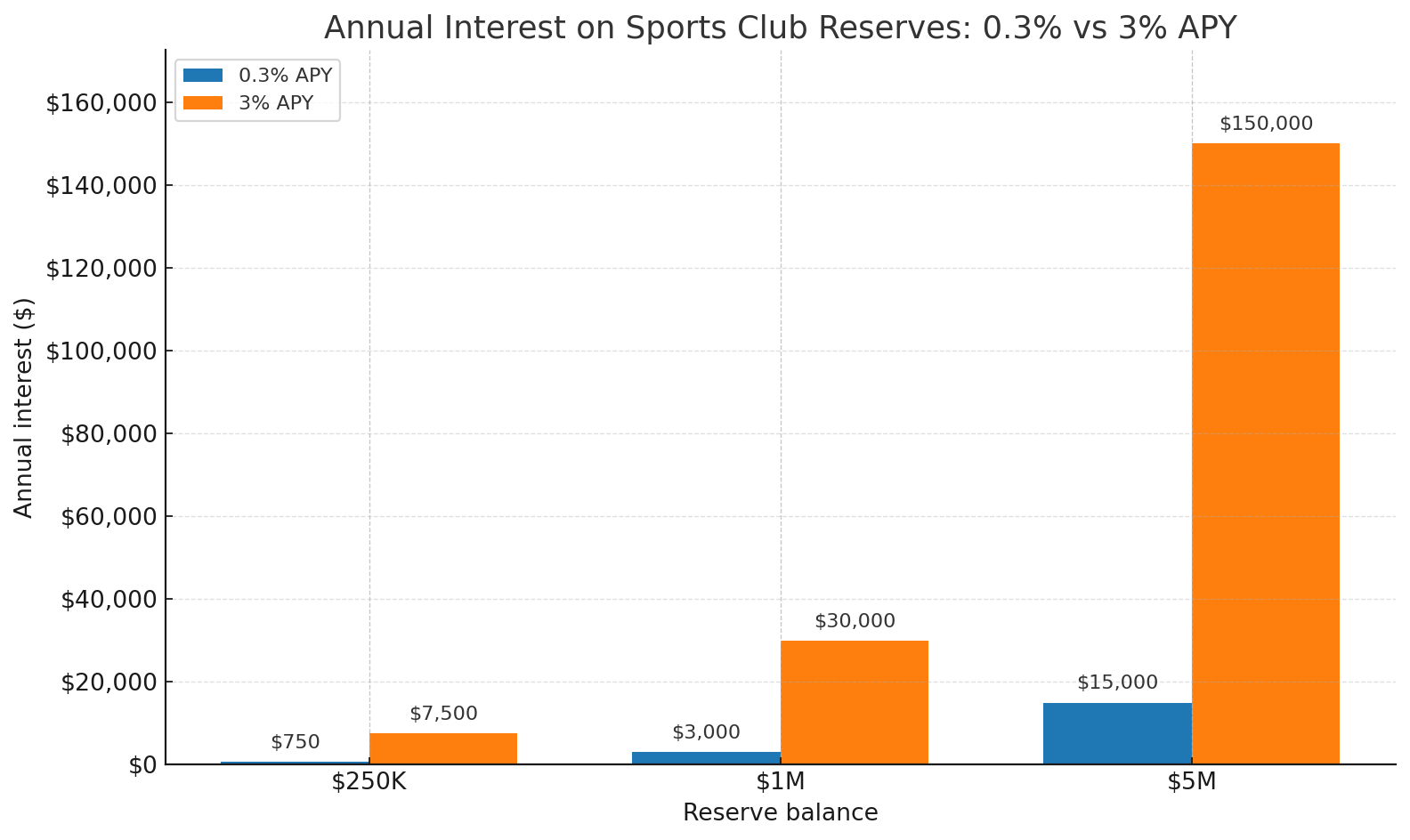

For sports organizations, every dollar saved or earned goes back into the mission. Whether it’s new equipment, fee scholarships for athletes, or facility upgrades. Yet too many clubs unknowingly bench their reserves in accounts yielding 0.1%–0.4% interest. Consider a mid-size hockey club that maintains a $1 million reserve for contingencies and off-season expenses. If that $1M sits in a typical bank at 0.3% APY, it earns only about $3,000 a year. In a 3% APY high-yield account, it would earn $30,000 – an extra $27,000 per year in free money. That $27K could cover about 45 player scholarships or tournament travel for multiple teams without a single new fundraiser. This is the “competitive funding gap” facing sports clubs: idle cash in low-yield accounts is a huge missed opportunity.

The urgency is clear. High-yield savings accounts (HYSAs) have exploded in popularity because they offer returns that are 8–10× higher than old-school bank rates. As of mid-2025, many top HYSAs pay 4–5% APY to individuals. Nonprofits and clubs can realistically get ~3% APY with specialized accounts – still about 8× the national average for savings. Meanwhile, the national average interest rate on standard savings accounts is only 0.38% APY (and big banks like Chase or Bank of America pay a trivial 0.01% on many business accounts). In real terms, leaving funds in a 0.1% account is like watching grass grow; moving to ~3% is like putting your money on rocket fuel. Every season you delay, your club leaves thousands on the table that could be invested back into athletes. It’s our fiduciary duty as club stewards to maximize those returns for our players and parents.

Example: The Falcon Youth Hockey Association kept $1M in a checking account at 0.3% APY. By switching to a ~3% yield, they’d earn an extra $27K in a year – enough to sponsor 45 athletes’ fees or buy new rink equipment. That’s a competitive edge in funding that most clubs simply overlook. Devote’s high-yield savings makes it easy to capture this “free” interest income with no fundraising required – so we can fund more scholarships and training programs just by optimizing where our reserves sit.

Rosters, Seasons, and Cash‑Flow Peaks: Why Sports Finances Are Unique

Running the finances of a sports club isn’t like running a typical business. Our cash flow has its own seasonal rhythm. For example, registration drives and membership dues surge at the start of a season, creating a big cash influx all at once. Mid-season, we often face spikes in spending – uniforms/equipment orders, tournament fees, and travel costs all tend to hit around the same time. Then there are off-season lulls where income slows to a trickle (but basic expenses like facility maintenance or utilities continue). This boom-and-bust cycle means club treasurers must carefully time our reserve usage to ensure we have funds when needed.

Unlike a business with steady monthly revenue, a soccer or baseball league might get 80% of its revenue in just a few months of registrations and fundraising events. That money might need to sustain operations for the rest of the year. As a result, sports clubs often hold large reserves short-term before outlays – for example, collecting $200K in travel team fees in spring that will be spent on tournaments over summer. The challenge is where to park those funds so they remain safe and instantly accessible for a rainy day (literally – if a tournament gets rained out and rescheduled, you may need to refund fees or pay new expenses on short notice). Many clubs default to leaving reserves in a checking account because they need liquidity for emergencies. But Devote’s solution offers both high liquidity and high yield, so you don’t have to choose between access and growth.

Sports finances also involve constant surprises: a van breakdown requiring immediate repair, a last-minute playoff qualifier requiring extra travel bookings, or a donor gift earmarked for a specific new project. We need our money available at a moment’s notice. With Devote, clubs get next-day liquidity with no penalties (and even same-day ACH transfers for urgent needs), so you can respond quickly while still earning interest up until the day you need to spend. That immediacy addresses the classic “what if we need the money tomorrow?” objection – Devote ensures you can have funds in hand when required, without sacrifice.

Finally, sports clubs juggle frequent capital expenses that hit irregularly: replacing all the soccer uniforms this year, investing in a new timing system for the swim team, resurfacing the gym floor, etc. We also handle big travel outlays – sending multiple teams to nationals, covering hotel and transport stipends. These costs don’t follow a neat monthly schedule. The good news is that during the months while cash is waiting to be used, it can sit in a high-yield Devote account earning for you. Then, whenever those costs come due, you transfer the money out (free and fast) – no hoops, no fees. In short, sports club budgeting is a rollercoaster, but a flexible HYSA ensures your reserves are always “in play,” even when parked.

Buckets = Clear Lines Between Programs

If your club is like most, you’re not managing just one lump sum of money – you’re managing multiple funds for multiple purposes. You might have an Operating Fund for day-to-day expenses, a Travel Team fund, a Scholarship fund for financial aid, a Facilities or Capital fund for upgrades, a Referee/Officials account, and separate pots for big fundraising campaigns or tournaments. Keeping those dollars straight is critical – board members and parents need to know, for instance, that the money raised at the Booster BBQ is still set aside for the new scoreboard, not accidentally spent on something else. Traditionally this is handled with messy Excel sheets or, worse, multiple bank accounts (one for each fund) that you reconcile by hand. 😫 Anyone who’s done “fund accounting” in a spreadsheet knows the pain – endless tabs, formulas, and chances for error.

Devote was built by people who know this nonprofit accounting headache. With Devote, you can create unlimited sub-accounts (or “buckets”) inside your main savings account. Each bucket acts like a dedicated virtual account with its own name, balance, and purpose. For example, you could have buckets for:

General Operations – core budget and reserve (e.g. “keep at least $100K for emergencies”).

Travel Teams – fees collected for competitive team expenses.

Scholarships/Financial Aid – donations or surplus earmarked to help families in need.

Facility Improvements – saving up for that new turf field or scoreboard.

Referee & Coaching Stipends – set aside to pay officials, coaches’ travel reimbursements, etc.

Fundraising Events – track proceeds from the annual fundraiser until spent on the intended project.

Setting up these buckets in Devote is simple and free (no extra accounts or fees needed). One club leader described it as “creating digital envelopes for each program” – you see exactly how much is in each fund at any moment, down to the penny. This clarity is huge for transparency and trust. Your board and donors can rest assured that if $10K was raised for the scholarship fund, it’s still sitting in the Scholarship bucket (and even earning interest for that purpose!). Quarterly statements even show interest earned per sub-account, so you can attribute growth to each program. No traditional bank is going to break out your tiny interest by sub-fund like that.

Perhaps most importantly, Devote’s buckets eliminate hours of manual bookkeeping. Instead of maintaining separate spreadsheets to track “how much of our one bank account belongs to which program,” you let Devote do it automatically. As Bryce Hansen (Devote’s co-founder) noted after working with a nonprofit managing dozens of restricted funds, they “relied on manual spreadsheets… countless hours of data entry and still struggled to maintain clear visibility” before switching to Devote. With unlimited buckets, that organization saved 10–15 hours a month and achieved real-time clarity on all funds. For volunteer-run clubs, freeing even 4-5 hours a month from tedious accounting means more time coaching, planning, or recruiting sponsors. We’re in this for the kids and community – not to be stuck in Excel hell. Devote gives you the clarity of separate accounts with the convenience of one platform, plus interest earnings on all funds. (Yes, even money sitting in the “referee fees” bucket accrues interest until you pay those refs!)

Case Study: Valley United Soccer Association Turns Idle Cash into 3 New Turf Fields

To see these benefits in action, let’s look at Valley United Soccer Association – a mid-sized youth soccer nonprofit with 850 athletes. With an annual budget around $2.5 million, Valley United typically kept about $750,000 in reserve for off-season and emergencies. Their treasurer had been banking locally, earning a mere 0.25% APY on that reserve (about $1,875 a year in interest). The club’s board always assumed such low yield was “just how it is” for nonprofits. That changed when a new Booster Club president ran the numbers: if they could get even 3.0% on that $750K, it would generate over $22,000 annually – effectively adding $20K+ to their budget every year without raising a dime of new revenue. That sum could fund the installation of several badly needed turf practice fields over a few years.

Valley United switched their reserve into a Devote Savings Account offering ~3% APY. Immediately, their interest earnings jumped from almost nothing to about $1,800 per month. In the first year, they earned roughly $20,000 in interest, which the board allocated toward a “Field Improvement Fund.” By the end of year two, that interest (plus a matching grant they secured, now easier to do with a healthier financial picture) paid for 3 new turf mini-fields for the club’s training facility – expanding practice space without tapping into operating funds. This tangible outcome got everyone’s attention. “Devote made it possible,” the treasurer noted, “to turn idle cash into real assets for our players.”

But the benefits didn’t stop at interest income. Valley United’s bookkeepers saved ~4 hours per month by using Devote’s integrated tools. Previously, they managed separate accounts for the travel teams vs. rec program and juggled clunky transfers when one needed funds from the other. With Devote, they created buckets for each program (Competitive Teams, Recreational League, Scholarship Fund, etc.) under one account, so moving money between purposes was just a few clicks with no transfer fees. The treasurer could easily sweep excess funds from the general operating bucket into the high-yield reserve buckets, and sweep back when needed, all within the same online dashboard. This streamlined approach meant fewer monthly bank reconciliations and no more accidentally using travel team funds to pay an operating bill – every expense came from the correct bucket. According to the treasurer, Devote “practically cut our bookkeeping in half”. And when auditors or the board wanted a report, showing how each designated fund was doing (with interest earned) was as easy as printing Devote’s statement instead of manually compiling spreadsheets.

Valley United’s success story underscores a powerful truth: idle money can do amazing things when put in the right place. By earning an extra $20K, the club achieved goals that would have otherwise required a major fundraiser or new donor campaign. The experience rallied board members around the importance of better financial stewardship. As one parent volunteer said, “We owe it to the kids to make every dollar count – seeing interest deposit into the scholarship fund each month feels like we’re finally doing that.”

Why Devote Beats Traditional Banks for Sports Clubs

At this point, you might be thinking: “This sounds great, but is Devote really that different from our current bank?” Let’s tackle that head-on. Devote is a financial platform built exclusively for nonprofits – and sports clubs, leagues, and booster associations are a major part of that family. Unlike generic banks, Devote understands the unique needs and pain points of running a volunteer-driven sports organization. Here are a few ways Devote outplays traditional banks for athletic clubs:

Market-Leading APY for Nonprofits: Devote offers one of the highest yields available to nonprofits, typically around 3.00% APY on all deposits. Most banks offer near-zero rates to small organizations – many clubs are stuck at 0.1% or 0.2% APY today. Devote’s rate is dramatically higher, meaning your reserves actively grow. It’s like earning a grant every year without any paperwork. And Devote’s rates stay competitive by leveraging a network of banking partners, so you consistently earn above the national average.

Unparalleled FDIC Insurance – Up to $50 Million: Typical banks insure deposits only up to $250,000 per account. That’s a problem if your club or booster program has a successful fundraising year or pools funds for a big capital project – anything over $250K is at risk if the bank fails. Devote solves this via an FDIC-insured sweep network, protecting deposits up to $50 million per tax ID. In other words, even the largest sports league or collegiate booster club can keep funds safe 100% above board. This will put your board members at ease – even the most cautious treasurer can’t object when every penny is federally insured 200× beyond the usual limit. (Try asking a big bank to do that for you!)

Same-Day ACH & Fast Access: Sports organizations can’t wait days for funds to transfer when an urgent need arises. Devote enables same-day or next-day ACH transfers, so you can move money to your regular checking account or make payments rapidly. Need to pay a tournament fee tomorrow? With Devote, initiate a transfer and the money’s there – no penalties, no delays. This responsiveness is crucial for handling those “need money now” moments (and it’s something many brick-and-mortar banks simply don’t offer to small nonprofits).

Unlimited “Buckets” at No Cost: As detailed earlier, Devote provides unlimited sub-accounts for organizing funds. And unlike some banks that might charge fees for multiple accounts or impose minimum balances, Devote’s buckets come free with your main account – no monthly fees, no minimum balance in each bucket. Traditional banks might make you open separate savings accounts (and maintain $X in each to avoid fees) if you want to segregate funds for, say, “Travel” vs “General”. With Devote, you just add a bucket in seconds. It’s true fund accounting built-in, at zero extra cost.

QuickBooks Integration & Receipt Capture: Devote isn’t just a bank; it’s also a spend management platform. Your Devote corporate cards (included if you want them) tie into the same system, so when coaches or staff spend money, transactions are automatically tracked to the right bucket/fund. The platform integrates directly with QuickBooks Online and other accounting software. This means no more manual data entry moving expenses into QuickBooks – Devote can sync transactions with one click. It even offers automatic receipt capture: team managers can snap a photo of a receipt with their phone, and Devote attaches it to the transaction record. These features save volunteer treasurers tons of time chasing receipts and updating ledgers. NerdWallet recently rated Devote a 4.4 out of 5, naming it the “Best Spend-Management Platform for Nonprofits”, largely because of these workflow benefits. The bottom line: Devote simplifies your banking and your bookkeeping.

Zero Fees & No Minimum Balances: Devote understands nonprofit budgets are tight. Thus, it charges no monthly account fees, no setup fees, and no withdrawal or transfer fees for the savings account. You aren’t required to keep a huge minimum balance either (just a token $1K to open, and after that no minimum). In contrast, many banks charge business accounts $10–$25 monthly or require an average balance to waive fees – money that could be going to your program instead. With Devote, every dollar goes toward your mission. Transparency is core to their ethos: no hidden fees, period.

Built by Nonprofit Experts, Tailored to You: Unlike big commercial banks, Devote is laser-focused on the nonprofit sector. Its team includes former nonprofit and community organization leaders who get the challenges we face. That’s why Devote’s platform addresses “specific workflows and challenges traditional banks don’t even know exist.” Sports clubs often feel like an afterthought at major banks – just another small business account. With Devote, you’re working with a partner that speaks your language. They even build new features based on customer feedback to solve real problems for clubs and charities. This mission alignment means you’ll never have to explain to your bank why you need multiple sub-accounts, or why multiple people need view access for transparency, or how your board approval process works – Devote has anticipated those needs. It’s a platform truly designed for people wearing the many hats of nonprofit sports management.

In short, Devote delivers the best of both worlds for sports organizations: top-tier financial performance (high interest, high insurance) and nonprofit-specific functionality (fund tracking, integrations, no fees). It’s “the best bank for athletic association reserves” not just because of a high APY, but because it addresses all the reasons you might have hesitated to move your money before. Worried your board won’t approve an online fintech? Show them the NerdWallet rating and the FDIC $50M coverage – that usually gets a nod of confidence. Concerned about liquidity? Devote’s got that covered with speedy transfers. Unsure about complexity? The interface is simple and your current finance workflows don’t get disrupted – in fact, they get easier. This is a solution built for us as club stewards.

Next Steps: Put Your Reserves in Play

It’s time to stop letting your club’s hard-won funds languish in sub-1% accounts. As leaders responsible for our athletes’ futures, we have a duty to make every dollar work for the team. Devote has made it simpler than ever to level up your financial game. Here are two easy ways to get started:

Calculate Your Club’s Lost Interest: How much interest are you leaving on the table? Use our “Calculate Your Club’s Lost Interest” tool to input your average reserve balance and current bank rate. You might be shocked at the annual dollar amount your club is missing out on. (For many, it’s enough to pay for an extra tournament or new gear each year.) This calculator will show you instantly what you could earn by switching to Devote’s high-yield savings – and that number makes a compelling case to any board. Put your reserve in play and see the potential gains.

Download the “Bucket Playbook” Worksheet: Ready to organize your finances like a pro? Grab our Bucket Playbook (free worksheet), which helps you map out all your club’s funds and programs, just like Valley United did. You’ll identify which “buckets” make sense for your club (operations, travel, scholarships, etc.), and how to allocate your current balances. It’s a great exercise to involve your finance committee or board in – and it will make the benefits of Devote’s sub-accounts very concrete. You can even bring the filled worksheet into a Devote onboarding session, and we’ll help you set up those buckets one by one.

Bottom line: Every season counts and so does every dollar. Devote’s high-yield savings account is the fastest, safest way to earn more on your dormant team funds – all while simplifying your workflow and safeguarding your money. By moving your reserves to Devote, you’re transforming idle cash into active support for your athletes. More interest earned means more scholarships, better equipment, more travel opportunities, and less financial stress on everyone. It’s rare to find a “win-win” in sports management, but this is one: zero downside, huge upside.

Don’t let your club fall behind in the funding game. Join the forward-thinking leagues and booster clubs who have already put their money to work for their mission. Put your reserves in play with Devote, and watch the impact grow – on and off the field. Your athletes will thank you when those extra funds translate into new uniforms, extra coaching, or that dream trip to Nationals. It starts with a smart financial move that any club can do right now.

Ready to act? Calculate your lost interest or download the playbook, and make the switch to Devote today. Let’s ensure every dollar scores for our team’s success.

Extra you earn with Devote annually$0

*Rates as of July 23 2025. Devote APY may change at any time.

**Demo assumes 365 days; National‑average rate from

Bankrate survey.